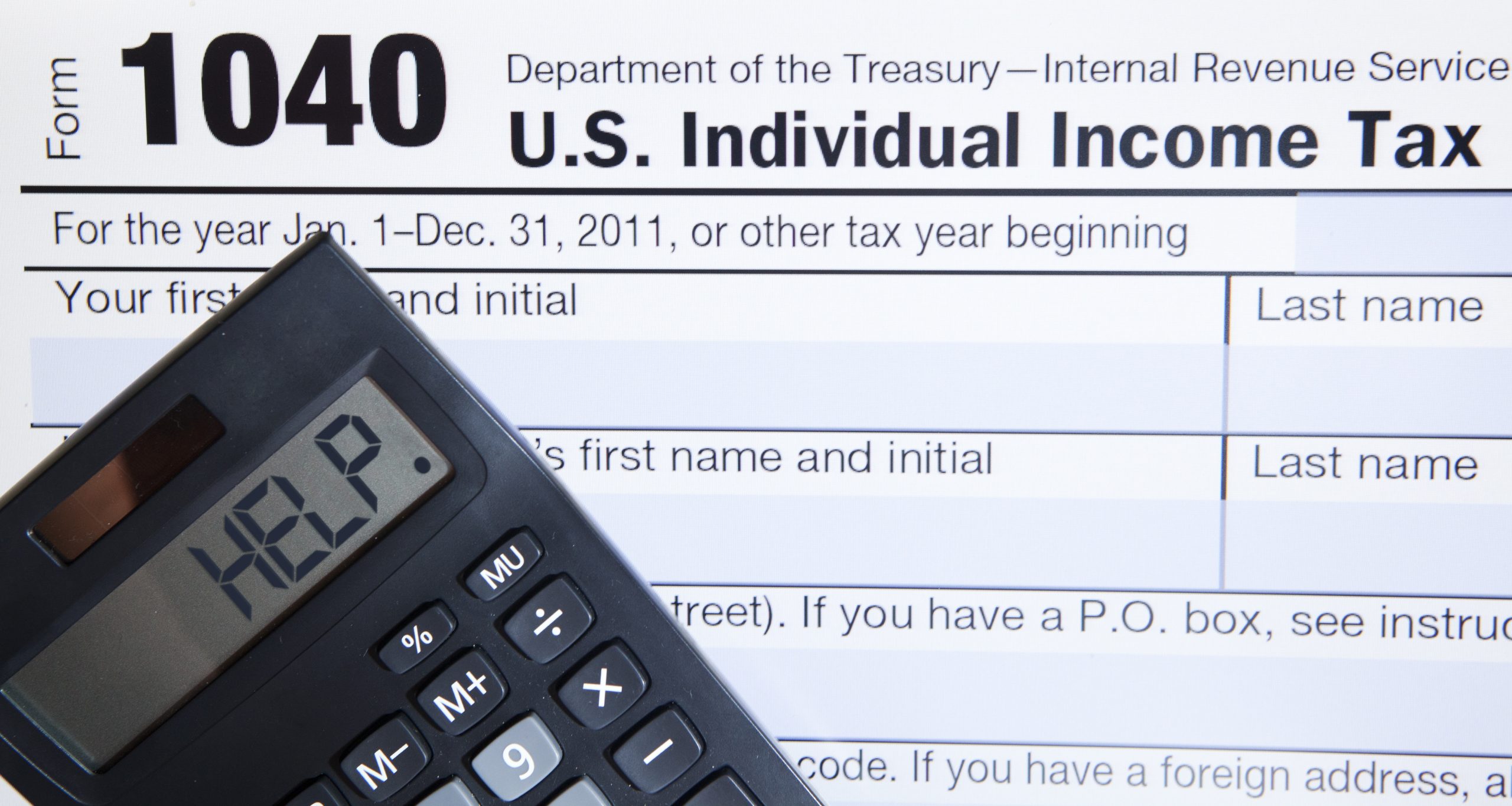

Tax season is one of those times that can be fraught with tension and uncertainty. Even if you have a straightforward and simple return, the idea of dealing with the IRS can make you feel uneasy. If you have experienced any of these situations in the past year, you should consider using a tax professional in Queens to prepare your return.

You Switched Jobs

If you changed jobs at some point in the past year, there may be benefits to hiring a tax preparer in Queens. They can help you find deductions and credits that might apply to your situation. For example, some training, relocation, or supply costs may be deductible under IRS rules.

You Own a Small Business

The same thing goes for business owners. Whether you run your business as a sole proprietor or the officer of a corporation, there are special tax considerations you should know about. A qualified and experienced tax professional can help you navigate business and corporate returns, so you don’t have to worry about it.

You Had a Change in Your Family Structure

Getting married, divorced, or having children can all impact your filing status with the IRS. And changes go beyond whether you are claiming single or head of household. There are also changes to deductions and exemptions.

Choose a Professional

When you decide to consult with a tax preparer in Queens, be sure to look for an experienced professional. Contact Business Name at website domain to learn how they can help you handle your personal and business tax obligations.